NC DoR 5PX 2005-2026 free printable template

Show details

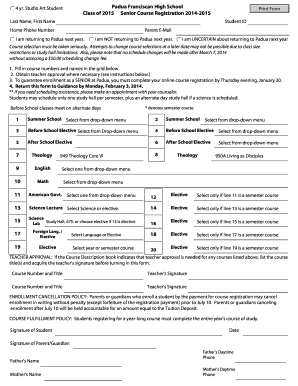

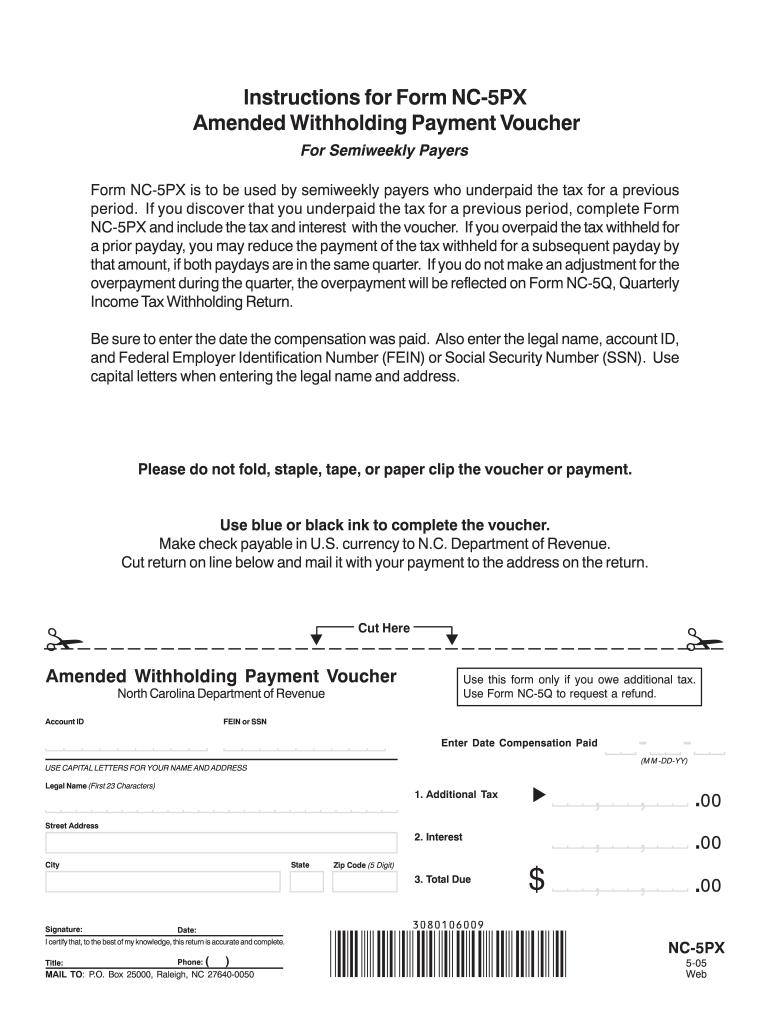

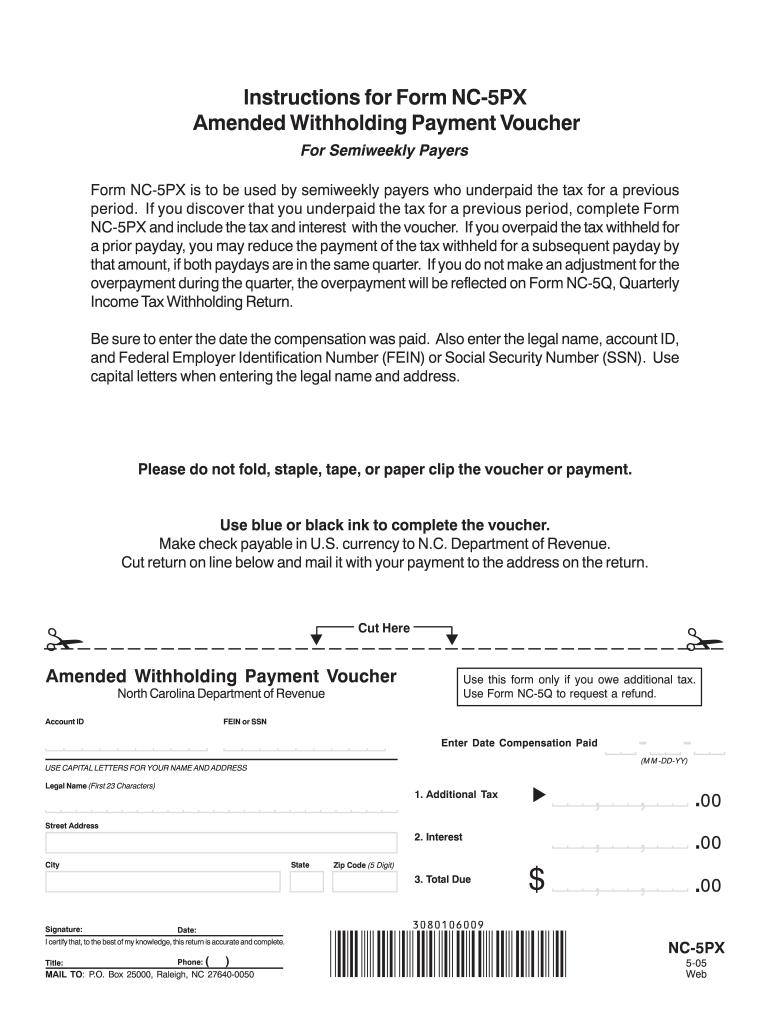

Instructions for Form NC-5PX Amended Withholding Payment Voucher For Semiweekly Payers Form NC-5PX is to be used by semiweekly payers who underpaid the tax for a previous period. If you discover that you underpaid the tax for a previous period complete Form NC-5PX and include the tax and interest with the voucher. If you overpaid the tax withheld for a prior payday you may reduce the payment of the tax withheld for a subsequent payday by that amount if both paydays are in the same quarter. If...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nc 5px form

Edit your pdffiller form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nc5 online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form nc 5 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nc 5 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nc5 form

How to fill out NC DoR 5PX

01

Obtain the NC DoR 5PX form from the North Carolina Department of Revenue website or your local tax office.

02

Enter your personal information such as your name, address, and Social Security number at the top of the form.

03

Provide the details regarding your income sources, including wages, self-employment income, and other earnings, in the designated sections.

04

Fill out any deductions or credits you are eligible for as outlined in the instructions provided with the form.

05

Review the entered information for accuracy and completeness.

06

Sign and date the form at the bottom.

07

Submit the completed form to the North Carolina Department of Revenue either by mail or electronically, if applicable.

Who needs NC DoR 5PX?

01

Individuals and businesses in North Carolina who are required to report their income for tax purposes.

02

Taxpayers seeking to claim credits or deductions on their state tax returns.

03

Anyone needing to report specific financial information related to taxes, as mandated by state regulations.

Fill

file nc 5 online

: Try Risk Free

People Also Ask about nc 5q online

What is the penalty and interest for NC 5?

The penalty for failure to timely file a withholding return is 5% of the tax due per month (maximum 25%). In addition, criminal penalties are provided for willful failure to comply with the withholding statutes.

What is the withholding limit for 2023?

For 2023, the maximum limit on earnings for withholding of Social Security (old-age, survivors, and disability insurance) tax is $160,200.00. The Social Security tax rate remains at 6.2 percent. The resulting maximum Social Security tax for 2023 is $9,932.40.

What is nc5p?

NC-5P, Withholding Payment Voucher.

What is NC 5P?

The NC 5P Form is a tax form that must be filed for anyone who owns or buys property.

What is the NC withholding for 2023?

For Tax Year 2023, the North Carolina individual income tax rate is 4.75% (0.0475). For Tax Year 2022, the North Carolina individual income tax rate is 4.99% (0.0499). Tax rates for previous years are as follows: For Tax Years 2019, 2020, and 2021 the North Carolina individual income tax rate is 5.25% (0.0525).

Are tax withholdings changing in 2023?

Broadly speaking, the 2023 tax brackets have increased by about 7% for all filing statuses. This is significantly higher than the roughly 3% and 1% increases enacted for 2022 and 2021, respectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my nc5x directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your nc 5q form and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit nc 5 online on an Android device?

You can edit, sign, and distribute NC DoR 5PX on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I fill out NC DoR 5PX on an Android device?

Use the pdfFiller mobile app to complete your NC DoR 5PX on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is NC DoR 5PX?

NC DoR 5PX is a form used by the North Carolina Department of Revenue for reporting specific tax information related to certain entities and transactions.

Who is required to file NC DoR 5PX?

Entities that meet specific criteria, such as certain businesses and organizations engaging in taxable activities in North Carolina, are required to file NC DoR 5PX.

How to fill out NC DoR 5PX?

To fill out NC DoR 5PX, you need to provide accurate information as requested on the form, including entity details, tax figures, and any relevant disclosures, ensuring to follow the instructions provided by the North Carolina Department of Revenue.

What is the purpose of NC DoR 5PX?

The purpose of NC DoR 5PX is to facilitate the collection of accurate tax information from businesses and organizations, ensuring compliance with North Carolina tax laws.

What information must be reported on NC DoR 5PX?

The information required on NC DoR 5PX typically includes entity identification, nature of business, income details, deductions, and any other pertinent information as stipulated by the North Carolina Department of Revenue.

Fill out your NC DoR 5PX online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC DoR 5px is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.